47 projects. One vision. Can Europe secure its critical minerals supply?

In this article you will find:

- The EU Strategic Projects represent Europe’s drive to secure critical minerals, reduce import dependency, and accelerate clean energy adoption. 47 projects were nominated for status in 2025 and another wave of initiatives expected in 2026.

- The Critical Raw Materials Act (CRMA) streamlines permitting, enables faster execution and is a pillar to attract 22.5 billion in investment.

- Europe stands at a strategic crossroads, navigating between China’s “electrostate” model and North America’s “petrostate” approach.

- Despite promises of streamlined permitting, execution risks persist. Many projects lack full funding and rely on early-stage technologies that may demand additional time and investment to become viable.

- Success depends on partnerships, technical innovation, and disciplined project delivery to turn policy into industrial reality.

- A digital download of our executive summary for a holistic EU Strategic Projects initiative analysis and our roadmap to its success.

This article serves as a timely reflection on the first wave of Strategic Projects: What’s been achieved, what challenges remain, and what lessons can guide the next phase. With the European Commission preparing for a second application round in January 2026, now is the moment to take stock and shape strategies for what comes next.

In an era defined by energy transition and digital acceleration, the European Union (EU) is advancing a coordinated strategy to secure the critical raw materials needed to support its industrial and defence independence.

At the heart of this effort is a portfolio of 47 strategic projects announced in March 2025 to address Europe’s supply gaps in essential minerals, including lithium, graphite, and rare earths. Long-term success will depend on a collaborative approach that unites stakeholders, governments, industry leaders, advisors, and financial institutions.

In addition to attracting investment, the initiative aims to reduce Europe’s reliance on imports from politically sensitive regions, stabilize pricing and supply for European manufacturers, and accelerate the adoption of green technologies, including EVs, solar, wind, and AI infrastructure.

Critical raw materials are essential for several crucial and rapidly growing sectors in the EU, underpinning the purpose of these Strategic Projects

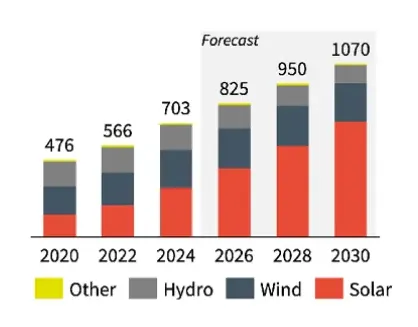

EU Total Renewable Energy Capacity (GW)

Solar energy has grown at a 22% CAGR (2020–2024) and is projected to remain the dominant source of renewable capacity in the EU.

Its deployment depends on critical minerals including copper, gallium, aluminium, and silicon metal, while associated battery storage requires graphite and boron.

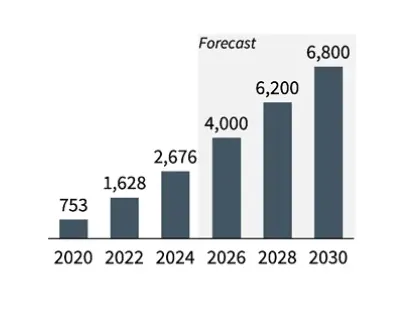

Europe EV Sales (‘000 vehicles)

Passenger car BEV sales have increased by 37% CAGR (2020–2024) and is projected to rise in line with EU regulatory mandates.

BEVs rely on critical minerals such as lithium, cobalt, nickel, manganese, graphite, rare earth elements, copper, and aluminium.

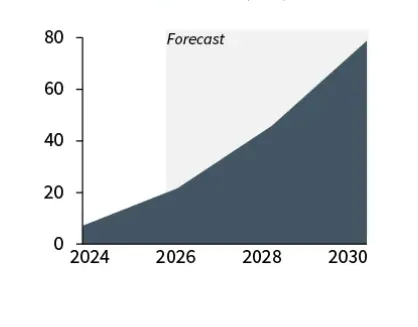

EU Cumulative Investment in Data Centres (€ bn)

AI‑driven data centre investments in the EU are projected to grow rapidly, reaching over €75 billion invested between 2025 and 2030.

Data centres and AI infrastructure rely on critical minerals such as copper, aluminium, REEs, cobalt, lithium, and silicon.

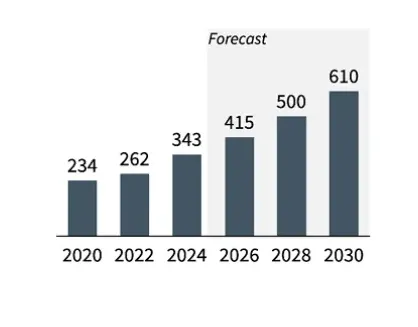

EU Defence Expenditure (€ bn)

EU defence expenditure is expected to rise by over €100 billion in real terms between 2025 and 2027.

The defence sectors relies on REEs, aluminium, tungsten, copper, cobalt, nickel, graphite, and PGMs.

Hatch assessed all 47 European Strategic Projects, evaluating readiness, financing, permitting, and strategic fit within the broader competitive and legislative landscape.

The findings highlight challenges and opportunities across the 47 projects—informing what can be done to advance them and shaping the next wave of strategic projects set to be announced in 2026.

A new regulatory landscape: CRMA in action

The groundwork for the Strategic Projects was laid in May 2024 with the enactment of the Critical Raw Materials Act (CRMA), a landmark regulation that ensures reliable access to materials vital for clean energy, digital infrastructure, and defense. One of its most impactful provisions is the dramatic reduction in permitting timelines, cutting approval periods from as long as 10 years to just 27 months for extraction projects and 15 months for processing.

To date, 10 projects have been permitted and 37 are still navigating the approval process. Historically, long and unpredictable approval timelines have stalled investment, inflated costs, and jeopardized viability. By accelerating permitting, Europe can unlock investor confidence, improve financing feasibility, and strengthen its global competitiveness.

The Strategic Projects will also receive coordinated financial support from institutions such as the European Investment Bank. Despite strong institutional backing, funding gaps remain across many of the projects. Only five of the 47 Strategic Projects are fully funded, underscoring the need to secure financing to move them from early-stage pilots and demonstrations to full-scale commercial operations serving the European market.

Many of the EU’s 2025 Strategic Projects remain in the early stages of development which creates headwinds for accelerating financing momentum. Of the 47 projects identified, 25 are still in pilot or demonstration phases, suggesting that technologies are still maturing and outcomes are not yet certain. These factors, combined with high upfront capital costs and a cooling commodity market, are influencing equity returns.

European governments have introduced subsidies to encourage private investment, particularly in sectors such as green steel and rare earths. However, current measures may not fully address the scale of the challenge. Moving from ambition to action will require additional steps to reduce risk and create the conditions for successful project execution.

Europe’s strategic crossroads

Europe sits at a pivotal crossroads, positioned between two dominant global economic models: China’s “electrostate” and North America’s “petrostate.”

China |

North America |

|---|---|

| China has aggressively positioned itself to dominate the global supply chain for electrification technologies. Its “electrostate” model is defined by: | In contrast, North America particularly the United States, remains anchored in a “petrostate” model defined by: |

|

|

| This model gives China substantial leverage over global clean energy and technology supply chains. For Europe, dependency on Chinese processing and technology represents not just an economic exposure but a strategic vulnerability. | This approach buys time for a gradual transition. Europe, by contrast, faces immediate supply-chain risks as it pushes forward toward rapid decarbonization, without comparable resource security. |

Many of the 2025 Strategic Projects are navigating complex permitting frameworks, scaling emerging technologies, and facing significant financing gaps. As EU Strategic Projects advances, it could reshape global sourcing strategies, create new trade alliances, and influence how other regions approach critical mineral independence.

But without the right advisory, investment, technical and commercial partners, timelines slip, costs rise, and strategic objectives falter. Turning policy into industrial reality demands technical precision, strategic foresight and a clear end-market

Ambitious targets, real risks

Collectively, the projects are designed to close supply gaps in critical minerals and materials, many of which are currently dominated by non-European suppliers. They aim to meet 10% of the EU’s demand through domestic extraction, 40% through processing, and 25% through recycling of strategic raw materials by 2030. To reduce dependency, no more than 65% of any material’s supply at any stage can come from a single non-EU country.

To reinforce its de-risking agenda, the European Commission in December 2025 unveiled a €3 billion strategy to accelerate the bloc’s push for supply-chain resilience. Under the new ReSourceEU programme, the EU will channel additional funding into domestic critical-mineral projects, expand recycling capacity for key inputs such as electric-vehicle magnet materials, and introduce rules to curb the export of scrap aluminium outside the bloc. As part of the package, the European Investment Bank has committed to provide up to €2 billion per year in financing for critical-mineral projects, including the 2025-designated Strategic Projects Keliber and Up Catalyst. The Commission will also consider financial mechanisms to help companies procure from higher-cost non-Chinese sources and will launch a “raw materials platform” to pool orders and build shared stockpiles. Additional export restrictions on scrap aluminium - and potentially scrap copper - are slated for 2026.

The initiative signals Europe’s determination to take control of its resource security, industrial competitiveness, and climate destiny. It’s a bold vision and delivering it will require coordinated action, clear priorities, and sustained commitment.

However, the technological readiness level (TRL) of several initiatives raises questions about execution risk. With many projects still in early development stages, how can Europe realistically deliver on this vision within the next five years?

Major project development is required to meet EU raw material demand, but execution risk is high due to early‑stage Technology Readiness (TRL)

From vision to execution: What it takes

The Strategic Projects initiative will test Europe’s ability to move from strategy to execution. Success will depend on turning regulatory momentum into real-world projects that are built, commissioned, and delivering value within a decade.

But streamlined permitting and funding alone won’t be enough. Execution will require:

- Technical innovation to scale emerging technologies

- Project discipline to manage complexity and timelines

- Trusted partnerships that bring together engineering, commercial, and regulatory expertise

Robust project execution plans are equally critical. Too often overlooked or overly optimistic, these plans must incorporate best-practice methodologies, including comprehensive project risk reviews and advanced techniques such as Schedule Risk Analysis (SRA) and Quantitative Risk Analysis (QRA), to ensure realistic timelines and resilient delivery.

At Hatch, we’ve tracked and analyzed all 47 of the 2025 Strategic Projects over the past year employing a comprehensive lens to evaluate each project’s position in the value chain, financing status, permitting progress, and TRL score. This review has given us a deep understanding of each project’s opportunities, challenges, the capital required to bring them to launch, and anticipated ramp-up schedule that takes into account the streamlined permitting opportunity and the maturity of the technologies deployed.

This analysis reveals both a challenge and an opportunity:

- A challenge to accelerate delivery in one of the world’s most complex regulatory environments

- An opportunity to lead in sustainable resource development, to deepen strategic partnerships, and to deliver measurable impact across Europe’s industrial ecosystem

As an investor, ask yourself: |

As a policymaker, ask yourself: |

|---|---|

| Are we positioned to invest in projects with the right mix of technical maturity and regulatory momentum? | Are our permitting frameworks aligned with the urgency of EU Strategic Projects timelines? |

| Do we understand the permitting landscape and how it affects project timelines and returns? | Are we deploying public capital strategically to unlock private investment? |

| How can we partner early to shape project outcomes and secure long-term value? | How are we supporting domestic capabilities in extraction, processing, and recycling? |

Want the full breakdown?

Download our executive summary for a holistic EU47 initiative analysis and our roadmap to its success.