A case for scrap-based steelmaking in South Africa

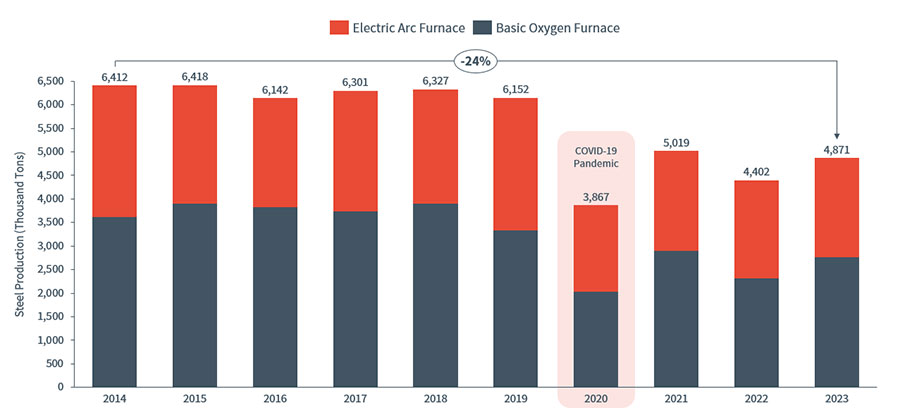

According to InvestSA, every 1,000 tons of locally produced steel contributes approximately R9.2 million to the national GDP and supports six jobs—three directly and three indirectly. Yet, despite this significant economic impact, South Africa’s steel production declined by an estimated 24% between 2014 and 2023, as shown below in Figure 1. This downturn highlights a critical gap between potential and performance. One that Hatch has helped address through advisory work with clients in the region.

Figure 1: Annual Steel Production Decline in South Africa (2014 – 2023)

In a recent strategic collaboration with a steel manufacturing client in South Africa, we explored the comparative advantages of locally beneficiating scrap steel versus exporting it for immediate financial gain. The assessment revealed, most notably, the potential for environmental sustainability, employment creation, and broader economic and industrial development. These insights offer a valuable blueprint for stakeholders seeking to unlock similar benefits through localized, low-carbon steelmaking strategies.

Environmental sustainability: A critical leverage point

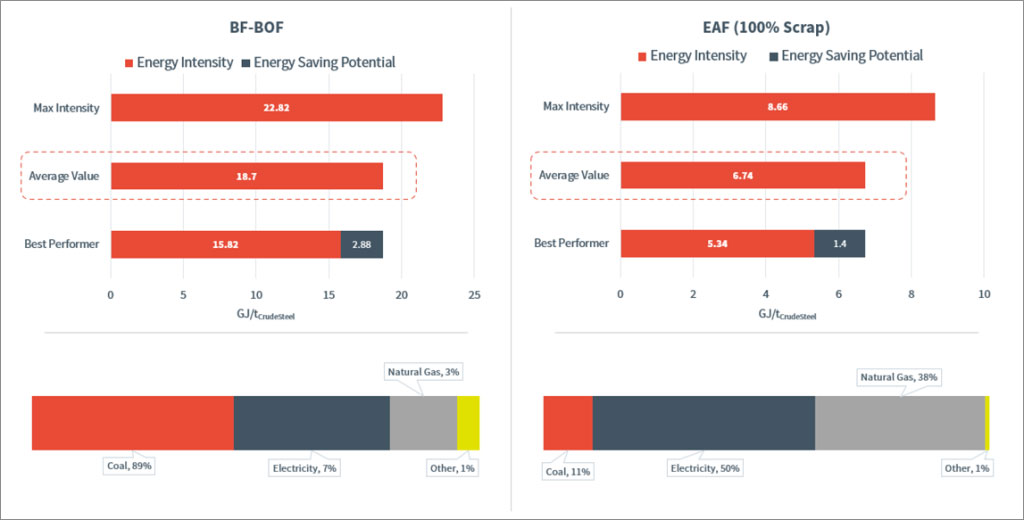

The steel sector accounts for an estimated 7–9% of global carbon dioxide (CO₂) emissions, underscoring the urgency of decarbonizing one of the world’s most carbon-intensive industries [1,2]. As part of this shift, the sector is moving from traditional blast furnace–basic oxygen furnace (BF–BOF) production toward electric arc furnace (EAF) technologies.

The BF–BOF process remains heavily reliant on chemical energy—93% of its energy input comes from coal, gas, and industrial fuels, with only 7% from electricity [2,3]. EAFs, in contrast, use a more balanced energy mix: approximately 50% electricity and 50% chemical input [2,3]. This not only enables emissions reductions but also facilitates greater use of recycled scrap, advancing the circular economy.

As this transition accelerates, scrap demand is projected to rise by 230 million tons between 2023 and 2040 [3]. Meeting this demand sustainably will require both innovation and scale. The International Energy Agency has emphasized the need to fast-track low-emission technologies to stay on course for net-zero emissions by 2050 [4].

Figure 2: Energy Source Breakdown in Steel Production: BF–BOF vs. EAF Methods

Employment and industrial growth: Strengthening domestic value chains

While environmental concerns provide the imperative, economic viability remains the catalyst. Recycling scrap steel reduces energy use, lowers production costs, and delivers recoverable value. In South Africa, ferrous scrap represents around 90% of traded scrap—both domestically and abroad [4,5]. In 2011, 40% of this was exported, generating an estimated R4.6 billion in revenue [4,5]. The remainder supported local mills and foundries.

This activity underpins a vital segment of the industrial economy. The scrap and foundry sectors contributed R24 billion to South Africa’s GDP in 2011, supporting more than 28,000 jobs across the value chain [6]. Strategic investment in this segment can yield tangible socio-economic dividends.

A moment of opportunity: Building a resilient, low-carbon steel industry

The South African steel industry stands at a pivotal crossroads. With the right investments, it can transition toward low-carbon production through scrap-based EAF technologies, underpinned by renewable energy integration. This alignment with global decarbonization targets presents both a competitive edge and a developmental imperative.

Demand for high-grade direct reduced iron (DRI) pellets and ferrous scrap is expected to climb, driving prices higher. While scrap supply will grow—particularly in China—much of it will remain in domestic markets, tightening availability elsewhere [7]. South Africa must plan accordingly.

There is an opportunity now to lead. By investing in technology, enabling supportive policies, and fostering innovation, South Africa can decarbonize its steel value chain, stimulate job creation, support downstream manufacturing, and build economic resilience. Aligning with international sustainability frameworks will secure the sector’s future competitiveness and ensure that the benefits of industrial transformation are shared widely and sustainably.

Partnering for a sustainable steel future

South Africa’s steel industry is at a defining moment. One that demands bold action, strategic investment, and innovative thinking. Transitioning to scrap-based electric arc furnace (EAF) steelmaking is not only an environmental imperative; it’s a pathway to economic revitalization, job creation, and industrial resilience.

At Hatch, we specialize in supporting clients through complex industrial transitions by offering a comprehensive and impact-driven approach that integrates techno-economic assessments, decarbonization roadmaps, policy advisory, and infrastructure planning. Our deep technical expertise across all viable steel production flowsheets and available technologies positions us to effectively assist both regional and international steel producers. As a technology-agnostic partner, we focus on identifying and deploying the most suitable processing routes to meet our clients’ strategic objectives. These may include scrap-based Electric Arc Furnaces or innovative pathways such as low-grade direct reduced iron electric smelting furnaces, depending on the specific context and goals. This flexibility enables our clients to reduce reliance on high-quality scrap, enhance cost-efficiency in steel production, and lower their environmental footprint through reduced carbon consumption compared to traditional blast furnaces, while also unlocking value from waste streams through iron recovery and the sale of slag to aggregate markets. Through this integrated and forward-looking approach, Hatch empowers steel producers to remain competitive and resilient in a rapidly evolving industry landscape.

Let’s build the future of steel together.

Connect with Hatch to explore how we can support your journey toward a low-carbon, circular, and competitive steel industry.

References:

- https://worldsteel.org/data/world-steel-in-figures/world-steel-in-figures-2024/

- https://imis.aist.org/AISTPapers/Abstracts_Only_PDF/PR-388-197.pdf

- Navigating the waves: Steel industry's raw material challenges in the green transition

- Iron & steel - IEA

- za-act-gn-2020-r746-publication-document.pdf

- List of Studies | Conningarth

- Rising demand for DR pellet, lump in emerging markets_ SIFW 2025 » DJJ

Khanyisani Makhanya

Consultant, Advisory

Khanyisani Makhanya is a Consultant in Hatch’s Advisory practice, holding both bachelor's and master’s degrees in mechanical engineering. With experience spanning FMCG, manufacturing, maintenance, and management consulting, he specializes in strategy, process optimization, and business transformation. Khanyisani leverages his technical expertise and practical insight to deliver measurable improvements in productivity, cost efficiency, and operational performance across diverse industrial sectors.