Key trends shaping the mining and metals sector in Southern Africa, Part 5: Maximizing value from capital spend

Throughout the last two years, there has been an uptick in capital spending by mining and metals players. The recent increase in capital projects in Southern Africa have faced several challenges, which include internal capacity to execute, availability of funding and skills, deteriorating sovereign ratings, and supply chain disruptions. These challenges have the potential to reduce project value and success.

While many of these challenges are external and need to be navigated, organizations have the most influence on the internal capacity to execute capital projects. In the past, owner-project teams have tracked in-line with capital projects spending. With the increased capital spending activity since 2018, owner teams must match requirements from the increase in projects.

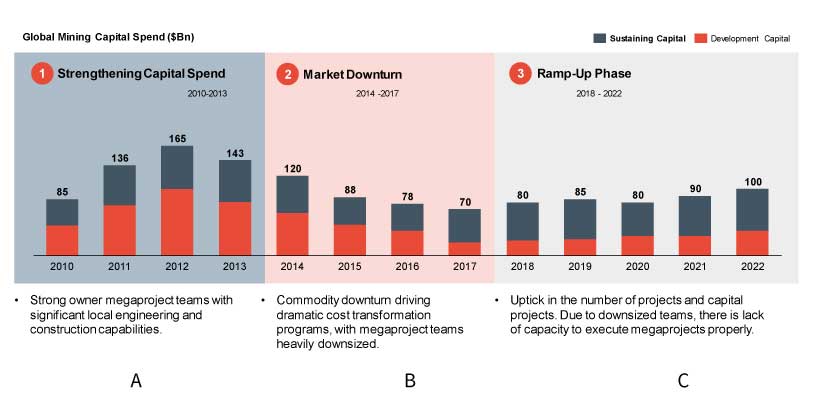

Exhibit 1: Capital projects and teams phases since 2010

- Strong owner megaproject teams with significant local engineering and construction capabilities.

- Commodity downturn driving dramatic cost transformation programs, with megaproject teams significantly downsized.

- Uptick in the number of projects and capital projects. Due to downsized teams, there is lack of capacity to execute megaprojects properly.

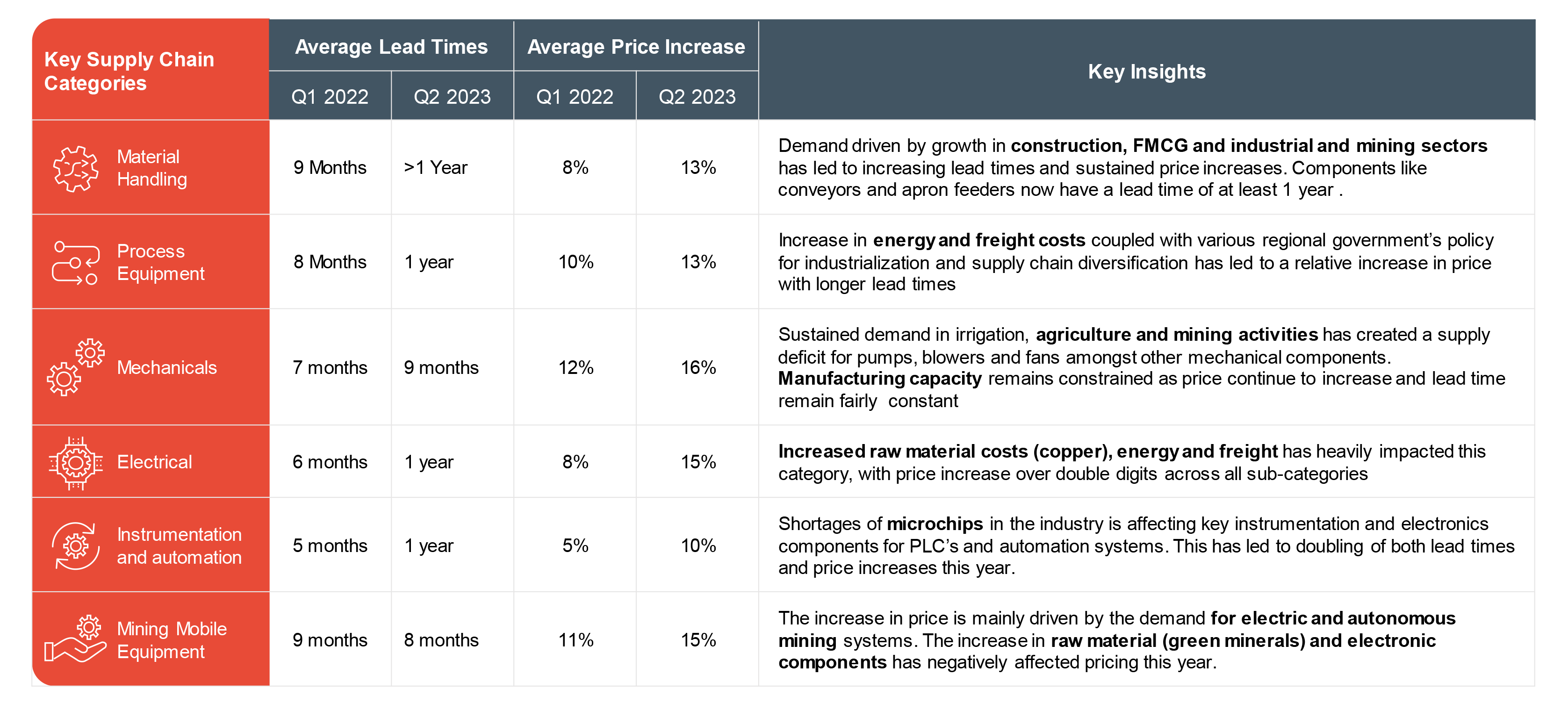

External disruptions have translated into increased lead-times and above-inflation price increases for key capital equipment. We have seen lead times of over a year for material handling equipment and nine months for electrical components and instrumentation. Similarly, the price increase for these categories have remained substantially high, increasing above inflation rates with 13%, 15%, and 10% for material handling equipment, electrical components, and instrumentation, respectively.

These lead times and price increases are mainly driven by the increase in the cost of raw materials (energy, copper, freight), limited manufacturing capacity, and limited supply in green battery minerals.

Exhibit 2: Supply chain categories lead times and prices increases

To maximize value from capital spend, organizations are implementing a three-dimensional approach:

- Adopt a portfolio approach to maximize value by shifting from project-level cost optimization toward portfolio-wide integration and business value delivery.

- Empower the owner’s team project team to be more effective by leveraging digital tools, increasing collaboration with business and project partners, and increased use of market insights.

- Use capital projects to improve operational performance by setting high performance and safety standards, entrenching new sustainability practices, and integrating digital ways of working.

Players are transitioning from cost-scrubbing to value-creation in capital project delivery. These transitions include a shift from traditional cost-saving initiatives to a holistic approach that takes into account net present value, additional revenue streams, cost savings and project structuring; a shift from a siloed decision-making approach at each project stage gate to dynamic business improvement decision-making initiatives; a shift from ad-hoc project optimization to systematic value driver review of opportunities; and lastly, a shift from the use of owner’s capital-project team to optimize projects to wider involvement of internal and external experts for outside-in perspectives when identifying and developing project improvement opportunities.

To empower owners’ teams and alleviate resource constraints when delivering capital projects, mining companies can leverage insights, technology, and organizational capability to proactively respond to market dynamics and global supply chain disruptions. This means a closer and earlier collaboration with experts both in and outside of the business, embracing digital technology, and leveraging insights from current market intelligence platforms and historical projects data. Finally, capital projects execution should be used as an opportunity to align the company’s target operating model by embedding operational strategy across the capital project value chain as follows:

- Operational strategy – Evaluate and select the correct strategic direction for the new operation by selecting the right organizational architype, planning to build new capabilities, establishing an asset management strategy, and incorporating the role of digital and analytics to achieve best-in-class business cases.

- Operational readiness planning – Prepare for execution by ensuring the budget and resources are in alignment with the strategy.

- Execution – Define ways of working and embed them within new operations. This includes developing standard operating procedures (SOPs) and KPIs aligned with the operational strategy and required performance levels, as well as setting a strong performance culture to ensure production targets are met or exceeded.

Contact Hatch for further information for additional insight on how mining and metals players are shifting their focus in efforts to maximize value from their capital spends.

This completes our five-part blog series. To view any of the previous parts of the series or to download the complete brochure, Key trends shaping the mining and metals sector in Southern Africa, please see below.

Key trends shaping the mining and metals sector in Southern Africa

- Part 1: Growth and portfolio diversification

- Part 2: Digital

- Part 3: Resilience in an uncertain business environment

- Part 4: Navigating pathways to net zero

- Part 5: Maximizing value from capital spend

Herman Strauss

Principal, Hatch Advisory

Herman Strauss is a Principal in the Advisory practice at Hatch where he supports clients across strategy and planning, deal advisory and implementation, as well as excellence in operations. He started his career at Hatch as a project engineer before joining a global management consultancy where he served mining and energy clients in South Africa, Indonesia, and Singapore. Herman has served clients across areas including strategy, technology enabled operations, restructuring, decarbonization and next zero strategies.