A tale of three scopes: Part 1

There is growing recognition of the significance of value chain emissions, known as scope 3 emissions, in the climate change strategies of metals and mining organizations. These companies are facing pressure to account for not only their own direct greenhouse gas (GHG) emissions but also for those of their suppliers, customers, transportation providers, and investments. In addition to scope 1 (direct emissions) and scope 2 (purchased electricity, heat, and steam), many now have scope 3 emissions reduction targets. With a greater focus on reducing emissions along the entire value chain, businesses are taking further initiative on climate change by striving to exert a positive influence across their entire supply chain ecosystem.

What are scope 3 emissions?

Scope 3 emissions are all indirect emissions (not included in scope 2) that occur in an organization’s value chain1. There are 15 categories of scope 3 emissions: 8 upstream and 7 downstream. For metals and mining organizations, the largest contributing categories are often:

Upstream:

- Purchased goods and services (e.g., production of purchased coke)

- Fuels and energy-related activities (e.g., production of purchased diesel)

- Processing and use of sold products (e.g., iron ore processing to crude steel)

- Transportation throughout their value chain (e.g., transporting sold products to customer)

Downstream:

Smaller but potentially significant categories can include capital goods, waste processing, business travel, employee commuting, and disposal of used products. Other categories are specific to the organization’s structure. These categories include leased assets, franchises, and investments including joint ventures. The following metrics can determine which categories are relevant and material to an organization:

- Size

- Influence

- Risk

- Stakeholders

- Outsourcing

- Sector-specific reporting guidelines.

Scope 3 measurement and accounting standards are continuously evolving in an effort to improve detail and transparency. It is recommended that organizations take initial steps to quantify their value chain emissions, and as new methodologies and data become available, update their inventories over time. The accuracy of scope 3 inventories is partially dependent on understanding your supply chain. As more organizations track their carbon footprint, supply chain emissions will become more transparent, enabling companies to better identify and reduce them.

Increasing relevance of scope 3 emissions

There is increasing pressure for organizations to quantify, track, and reduce their environmental impact. We have observed these pressures from a compliance perspective (e.g., proposed mandatory disclosure of GHG emissions and other climate-related information annually in some jurisdictions) as well as on a voluntary basis (e.g., due to shareholder pressure, conforming to industry-specific public disclosure standards, product positioning). Notably, we have seen many of our clients request product carbon intensities to better understand their own scope 3 emissions and seek low-carbon raw materials in pursuit of their sustainability goals.

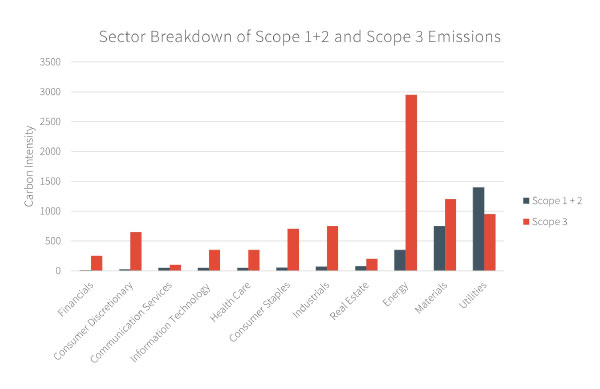

Scope 3 emissions can represent a sizable portion of a companies’ total emissions. This is observed strongly in iron ore, where for example, BHP’s scope 3 emissions represent around 99% of their total emissions2.

Source: S&P Global. Data as of December 2020. For illustrative purposes only.3

The Science-Based Targets Initiative (SBTi) states that if an organization’s scope 3 emissions are greater than 40% of their total emissions, these emissions represent a significant business risk. These pressures are cumulating and encouraging organizations to quantify their scope 3 emissions inventories and set reduction targets.

How we can support extractive resources companies

We are well positioned to support organizations in quantifying their scope 3 emissions, either for the first time or to refine previous methodologies. Our dedicated climate change experts can support with:

- Defining scope 3 reduction targets

- Developing inventory methodologies and calculations

- Navigating regulatory requirements

- Identifying decarbonization opportunities and strategy for scope 3 emissions

As scope 3 continues to evolve and becomes critical to decarbonizing entire value chains, we are well positioned to support your organization by leveraging the wealth of experience of our multi-disciplinary experts across sectors and practices.

References

Matthew Tutty

EIT | Climate Change and Sustainability, Climate Change Business Practice

Matthew is an Engineer-in-Training with expertise in climate change. He has broad experience across various aspects of developing climate change strategy including quantifying emissions inventories, climate-related risk analysis, and identifying greenhouse gas emission reduction opportunities. Matthew has worked with many key metals accounts to define strategies to achieve their decarbonization goals.

Recent work Matthew has been involved in includes developing product carbon intensity calculation methodologies for the base and precious metals products and quantifying at a concept-level and early engineering stage decarbonization opportunities. Matthew’s dedication to community development was recognized with the Engineers’ Canada Gold Medal Student Award in 2021 which recognizes the exceptional achievements of an undergraduate engineering student who has demonstrated leadership, resiliency, and positive impact in their engineering studies and community.